Concordia School District to Approach City About Gym Partnership, Funding Options

The USD 333 Concordia Board of Education agreed Monday, March 13th to have Superintendent Quentin Breese schedule a study session with the members of the Concordia City Commission to delve into a potential city-school partnership on a new gymnasium space intended to serve the needs of the school district and the community, as well as explore the possibility of attaching a corresponding citywide sales tax issue to a prospective bond issue to fund various improvements to Concordia Junior/Senior High School.

During a special called meeting in October 2022, the school board began revisiting conversations about improving and upgrading the facilities in the district, their first formal conversations as a board following the defeat of a $48.5 million bond issue in the fall of 2021. The board has been exploring options for renovations with no demolition required to the existing facility.

Tucker Peddicord with Lighthouse Construction Guidance presented an updated renovation plan at an estimated cost of $23.1 million, revised down from a $33.6 million project reviewed by the board during a work session held on January 13, 2023. The revised total removed brick and stone repairs, metal panel roof replacement, and half of the planned HVAC and electrical gear upgrades from the scope of the project. A classroom bar elevator, projected to cost approximately $550,000, and other miscellaneous improvements, such as entrance security, new seating, lighting and finishes in the auditorium, and general finishes to areas like the library, band and music rooms, cafeteria and more, were also excluded from the latest proposal.

"This is what a bare-bones project would look like," Peddicord said. "We didn't reduce any of the program enhancements because that is really putting dollars into the classroom. We left that alone."

"I'm not saying that this is what you should do. I'm saying that if we were to do a plan like we were looking at, this is what you would have left for everything else if you were trying to stay under $30 million," Peddicord added.

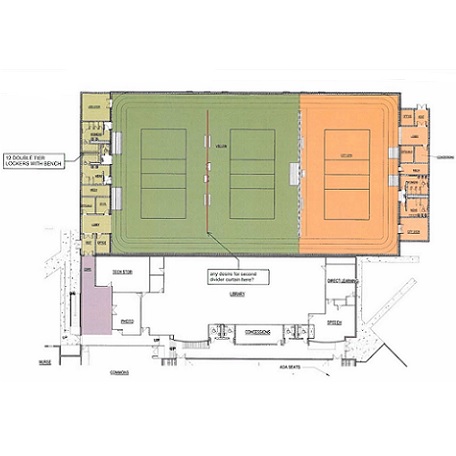

Peddicord also discussed plans to construct a new auxiliary gymnasium for the district, to be built on 10th Street with a connecting link added from the existing building to the new gymnasium. The total estimated cost of the gym, which Concordia students would be able to utilize for games, practices and physical education class, is $5,071,198. Peddicord said the space could be expanded to fit three courts and serve multiple purposes for an additional $6,885,269.

There's been growing concerns over the playing conditions of the current Concordia High School Junior Varsity gymnasium. The new auxiliary gym has been presented to replace the existing JV gym, providing Concordia Junior/Senior High School with two playable facilities.

Last fall, a group targeting a facility for seniors in the community presented an idea to the Concordia City Commission for a community activity center that could include an indoor walking track for members of the public to walk during inclement or cold weather, an indoor pickleball court, two-to-three basketball and volleyball courts, a multi-purpose meeting room, a kitchen and concessions area, an indoor "tot lot" jungle gym for young children, and the ancillary spaces that normally accompany a space of this type. Originally, the group had identified Rasure Field, a city-owned property on the southeast corner of East 7th Street and Cloud Street near the Concordia Sports Complex, as a possible site for the proposed facility. A formal cost estimate has not been obtained for the facility.

The group had asked the city to consider a special sales tax to assist with fundraising for this project, and for the city to assume ownership and operational responsibility of the facility once complete.

At that meeting in October 2022, the city commission informed Concordia City Manager Amy Lange they'd like to see the city work in conjunction with the school district, Cloud County Community College and the grassroots group to figure out what a community activity center may look like and evaluate what the community, in general, would support.

The school district feels strongly that a sales tax increase needs to be part of the funding equation for facility improvements. Previously, Concordia voters rejected a proposed one-percent citywide general purpose sales tax that would have helped fund identified school improvements in the fall of 2021.

"We still feel, when you look at what just a $20 million project would cost us, trying to do it on our own, 12 mills is a large mill increase for this tax base to withstand. So we really feel like one of our best options is to work with the city to offset some of that with a sales tax option," Superintendent Breese said Monday. "Trying to meet the needs of the city piece with this configuration felt like a win-win, because the city needs space as well, and then we also need space. This covers both sides of the coin, so to speak."

In January 2023, Dustin Avey, Managing Director of Piper Sandler, presented preliminary financing information, outlining for the board of education several mill levy impact scenarios of a $30 million bond over 20 years without a corresponding sales tax issue, with a one-percent citywide sales tax increase for the full-term, and with a one-percent citywide sales tax increase to sunset at 10-years. According to the information provided, property taxes on a home valued at $100,000 on a 20-year bond without sales tax support would increase $21.30 per month, or $255.63 annually. A 20-year bond with a one-percent sales tax for 10 years would see property taxes on a home valued at $100,000 increase $11.48 per month, or $137.76 annually. And a 20-year bond with a one-percent sales tax for the full-term would see property taxes on a home valued at $100,000 increase $5.49 per month, or $65.88 annually.